If you are running digital advertising campaigns in Malaysia specifically on Google, Facebook (Meta), LinkedIn or TikTok, you might want to pay attention to the Withholding Tax (WHT).

Since 2017, LHDN (Inland Revenue Board in Malaysia) has classified payment to Google, Meta, LinkedIn, TikTok advertising as “royalty” hence 8% Withholding Tax applies.

You can read the in-depth coverage on this topic here, to understand why you need to factor in Withholding Tax in your advertising cost.

This article will focus on the submission process of Withholding Tax. You are at the right place here if you are looking for Google, Meta, LinkedIn, TikTok Certificate of Residence (COR), or even the corresponding Tax Identification Numbers (TIN) so read on!

Instead of the standard 10% WHT required for royalty, you just need to factor in 8% WHT for royalty payments to Singapore and Ireland under the Double Taxation Agreement (DTA) scheme.

In case you are wondering, in this part of the world, Google, LinkedIn and TikTok bill from Singapore while Meta invoices from Ireland.

To be entitled to 8% WHT, you need to submit COR, also known as Tax Residency Certificate (TRC), as a supporting document. This is to prove that Google, LinkedIn, TikTok are Singapore tax residents, and Meta is an Ireland tax resident.

Do take note that COR is only valid for a year so you need to have a copy for every year you are claiming 8% WHT.

The challenge here is COR is not easily obtainable on the Internet. Don’t worry though as we have acquired all the Google, Meta, LinkedIn & TikTok COR from 2017 to 2024, just read on to find out how you can download the documents.

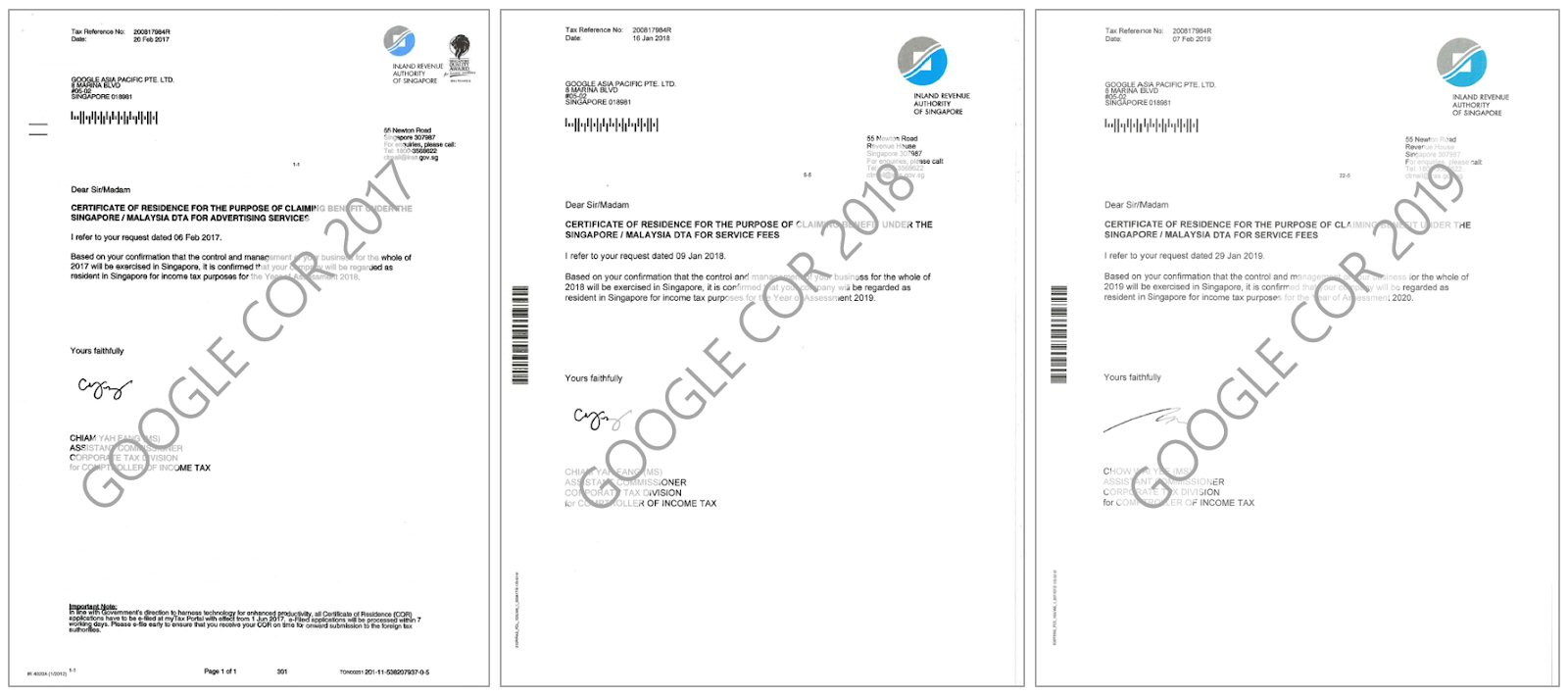

Google COR – Singapore (Preview)

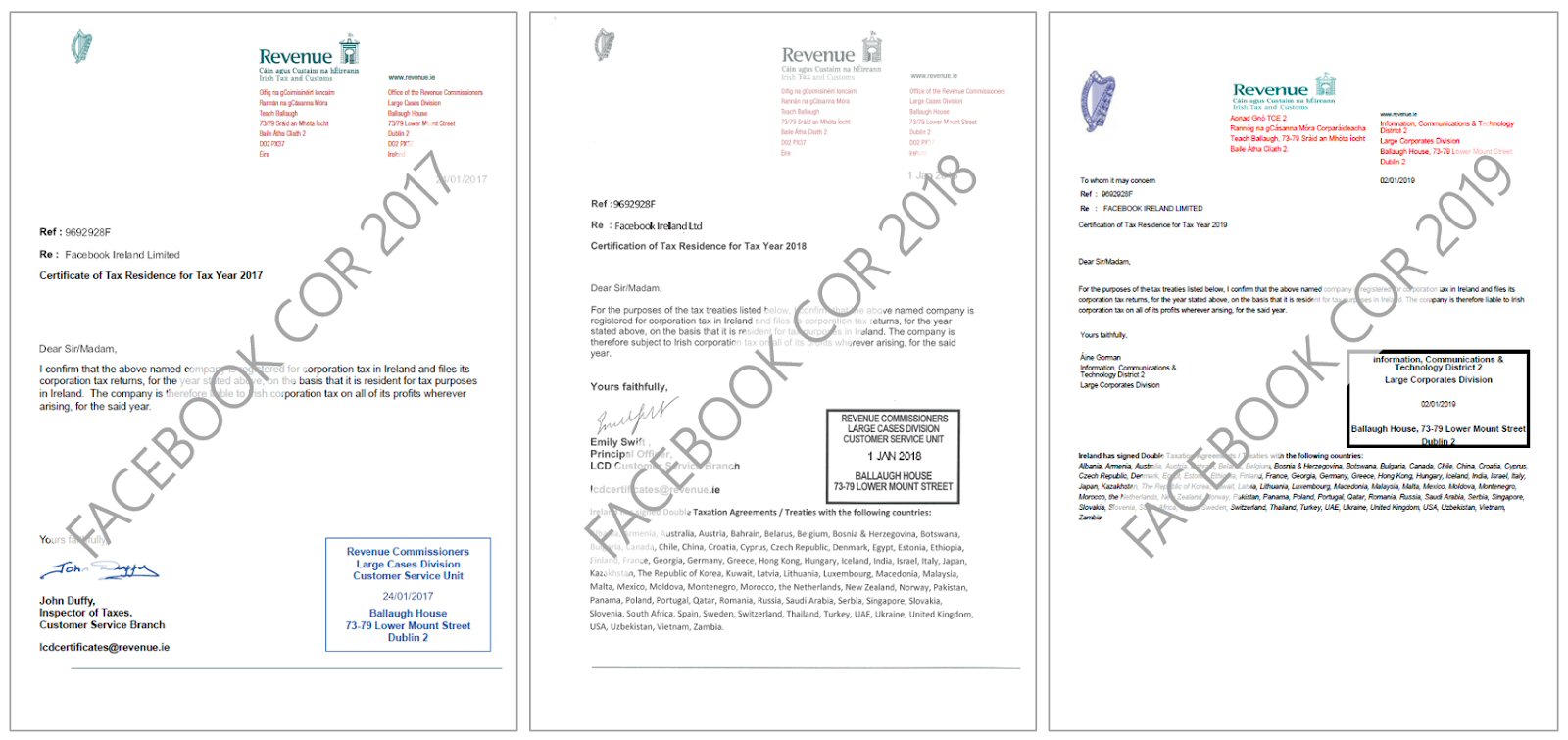

Facebook (Meta) COR – Ireland (Preview)

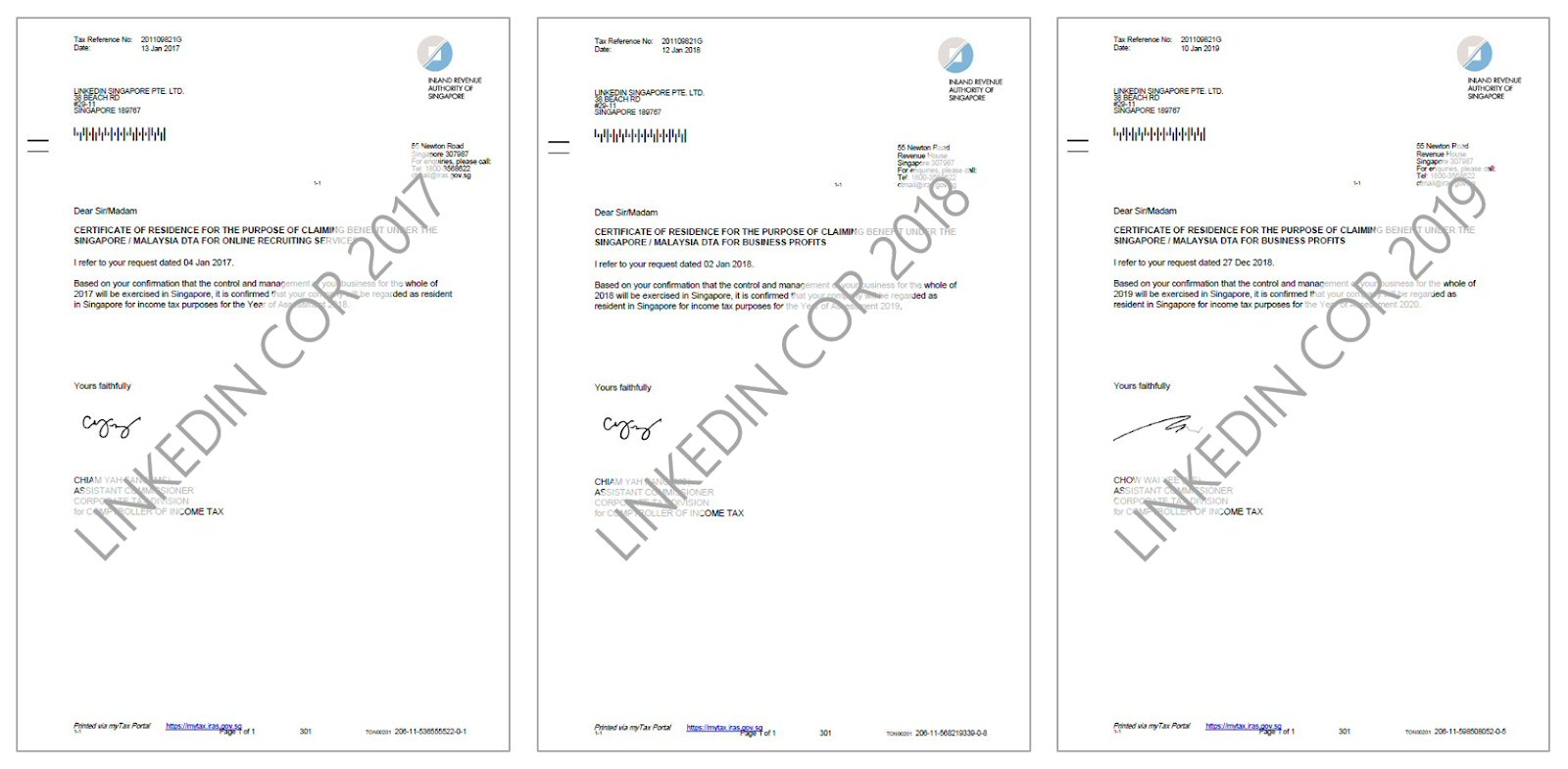

LinkedIn COR – Singapore (Preview)

Download Google, Facebook (Meta), LinkedIn, TikTok* COR 2017-2024

Since we are making your life easier by having all the CORs in one go, how about buying us a coffee?

- Pick the latest or past COR document(s) from the tables below.

- Make payment via PayPal (either with your credit card or PayPal balance).

- Enter your email correctly in PayPal as the download link will be sent to your email automatically.

Do take note that Google, LinkedIn, and TikTok COR are issued in Singapore while Meta COR is issued in Ireland.

All the info is clearly stated here so we will not respond to any inquiry before or after you download. Rest assured that the documents can be used to submit to the authority in Malaysia, as we are using them ourselves.

No receipt will be issued, you can refer to your PayPal transaction for the payment proof.

Latest CORs (2024)

| COR Document | Pay & Download |

|---|---|

| Google COR 2024 (1 doc) | RM20 |

| Meta COR 2024 (1 doc) | RM20 |

| LinkedIn COR 2024 (1 doc) | RM20 |

| TikTok COR 2024 (1 doc) | RM20 |

| [Combo] Google & Meta COR 2024 (2 docs) | RM35 |

| [Combo] Google, Meta, LinkedIn COR 2024 (3 docs) | RM45 |

| [Combo] Google, Meta, TikTok COR 2024 (3 docs) | RM45 |

| [Combo] Google, Meta, LinkedIn, TikTok COR 2024 (4 docs) | RM50 |

Past CORs (2017-2023)

| COR Document | Pay & Download |

|---|---|

| Google COR from 2017-2023 (7 docs) | RM20 |

| Facebook/Meta COR from 2017-2023 (8 docs) * | RM20 |

| LinkedIn COR from 2017-2023 (7 docs) | RM20 |

| TikTok COR 2023 (1 doc) ** | RM20 |

| [Combo] Google & Facebook/Meta COR from 2017-2023 (15 docs) | RM35 |

| [Combo] Google, Facebook/Meta & LinkedIn COR from 2017-2023 (22 docs) | RM45 |

* There are 2 Facebook CORs available for the year 2022 (issued by FACEBOOK IRELAND LIMITED and META PLATFORMS IRELAND LIMITED) for downloads after 8 Feb 2023. From 2023 onwards, there are only Meta CORs issued by META PLATFORMS IRELAND LIMITED.

** TikTok COR is only available for the year 2023 onwards.

How to submit Withholding Tax payments?

You will need to have the VA number ready before the submission. e-TT is a system that will generate a Virtual Account Number (VA) as payment identification. Taxpayers who wish to pay tax are required to access the eTT system with the following steps:

- Visit the MyTax Portal at (https://mytax.hasil.gov.my)

- Click on ezHasil Services > e-TT (https://ett.hasil.gov.my/va?lang=EN)

- Fill up the required payment information to generate the VA number

- Use the VA Number as the payment account number when making payment

No. Pengenalan Cukai Malaysia (TIN)

Besides the COR, you will need to fill up the Nombor Pengenalan Cukai Malaysia or Tax Identification Number (TIN) in Form CP37 while submitting the Withholding Tax payment.

Unfortunately, TINs are not easily available publicly for foreign Internet service providers like Google, Meta, LinkedIn, TikTok etc. so it has taken us years to acquire these TINs.

To make your life easier, buy us another coffee 🙂 as we have compiled the list of TINs for service providers below. We might not have every TINs you need so please check the following table carefully first before you download.

| Foreign Service Provider | Tax Identification Number | Pay & Download |

|---|---|---|

| GOOGLE ASIA PACIFIC PTE LTD | CXXXXXXXXXXX | RM20 This list will be sent to you with the TINs unmasked |

| GOOGLE INC WAZE ADS | CXXXXXXXXXXX | |

| META PLATFORMS IRELAND LTD | CXXXXXXXXXXX | |

| LINKEDIN SINGAPORE PTE LTD | CXXXXXXXXXXX | |

| TIKTOK PTE LTD | CXXXXXXXXXXX | |

| PREMIUM BEAT COM | CXXXXXXXXXXX | |

| INTUIT LTD | CXXXXXXXXXXX | |

| SOUNDSTRIPE INC | CXXXXXXXXXXX | |

| FREEPIK COMPANY S.L | CXXXXXXXXXXX | |

| FIVERR INTERNATIONAL LTD | CXXXXXXXXXXX | |

| SHUTTERSTOCK IRELAND LTD | CXXXXXXXXXXX | |

| UBERSUGGEST | CXXXXXXXXXXX | |

| MANGO TECHNOLOGIES, INC.BDA CLICKUP | CXXXXXXXXXXX | |

| NAMECHEAP, INC. | CXXXXXXXXXXX | |

| EPIDEMIC SOUND AB | CXXXXXXXXXXX | |

| ENVATO PTY LTD | CXXXXXXXXXXX | |

| OUTBRAIN INC | CXXXXXXXXXXX | |

| INMAGINE LAB PTE LTD | CXXXXXXXXXXX | |

| JASPER | CXXXXXXXXXXX | |

| WPFORMS, LLC | CXXXXXXXXXXX |

Note: For online submission, you can enter the TIN and the corresponding Foreign Service Provider (Nama Penuh Penerima) will be prompted accordingly.

When do you need to submit WHT payments?

You might be wondering, when and how frequently do you need to submit WHT payments to LHDN? You are required to do so within 1 month from the date you make the payment to Google, Meta, etc.

Depending on your payment terms with Google, Meta & co, most likely you need to make WHT payments every month or at least bi-monthly.

Hi, will 2023 to be available in your site for sell soon?

Hi, usually by end January or early February, will update here ya once it’s ready.

hi,

I’m waiting to buy FB 2023 COR also. Pls update asap once ready ya tqvm.

Sure will do, Meta is unbelievably slow this time 🙂

Hi, Meta (Facebook) COR 2023 is now available ya 🙂

hi

when can get 2023 Meta COR?

Hi, it is not available yet but we will update here once it’s ready, thanks!

Hi, Meta COR 2023 is now available ya 🙂

hi when will be the Meta COR ready?

Hi, not sure why but Meta is extremely late this year, will update here once it’s ready, thanks!

Hi, Meta COR 2023 is now available ya 🙂

hey, do you have a tax residency certificate in 2023

Yes, 2023 docs are available, you can check on this page.

Hi, is there COR for Twitter International Company (address @ Ireland)? If yes, would you be able to obtain it for us to buy here?

Hi, we don’t have COR for Twitter, will update you here if we have it in the future, thanks!

Hi, may i know Meta COR 2023 need to pay?

Hi, as stated above in this article ya.

Hi, is there COR for Shopify Commerce Singapore Pte Ltd?

Hi, unfortunately nope 🙂

Halo,

Do you have a tax residency certificate in 2023? What region do you have for COR Meta and Google documents?

Hi, all the info you need is actually stated in the article above 🙂

Hey thanks for COR, but as far as I can understand, all of the Google Singapore COR is specific for the purpose of claiming withholding tax in Malaysia, right? So do you have a more ‘general’ COR for Google Singapore? Like the Google Ireland COR. Thanks

Hi, not really sure what you meant by general COR but anyway we only have this version ya.

Okay no problem. Thanks alot for the reply

do you have the Shopify tin number for purchase?

Hi, we don’t have it yet but will update here if we manage to get it 🙂

Hi, do you have Indeed Singapore COR, and Microsoft Ireland COR?

Hi, sorry we don’t have these 😅

do u have COR for Autodesk – Digital River Ireland Ltd ?

Hi, sorry we don’t have these 😅

Google COR 2023 is Google Asia Pacific Pte Ltd or Google Ireland Limited?

GOOGLE ASIA PACIFIC PTE. LTD.

Can you obtain Shopify’s COR?

Don’t have yet but will try 🙂

Hi, Just Purchased of Google COR from 2017-2022 (6 docs) from your side. paypal payment is done. May i know where to download the COR ?

Hi, your payment is flagged by PayPal as pending so we haven’t received the fund yet, perhaps you can check your payment source whether the payment has gone through. FYI, the download link will be emailed to you automatically upon successful payment.

Hi, we have received an update that your payment is approved by PayPal now and you should have received an email to download the docs, thanks!

Hi Team ,

Do you have year 2024 COR ( Certificate of Residence) like Meta , Google(Singapore) , Mircosoft (Singapore) , TikTok & etc ?

Hi, COR docs are usually available by the end of Jan or in February ya, do revisit this page to check, thanks!

p/s: Btw, we don’t have Microsoft COR.

Hi, is your Google COR 2024 under GOOGLE ASIA PACIFIC PTE LTD?

Hi, yes it is GOOGLE ASIA PACIFIC PTE LTD.